IFSC Codes: Foundation of India’s Digital Economy The Indian Financial System Code (IFSC) has become the central pillar of secure and seamless digital banking in India. Every time a person initiates an NEFT, RTGS, or IMPS transaction, the IFSC code plays a critical role—ensuring funds are sent to the correct branch and recipient within seconds….

Tag: RBI

RBI’s New Digital Payment Authentication Rules: A Deep Dive for Secure Transactions

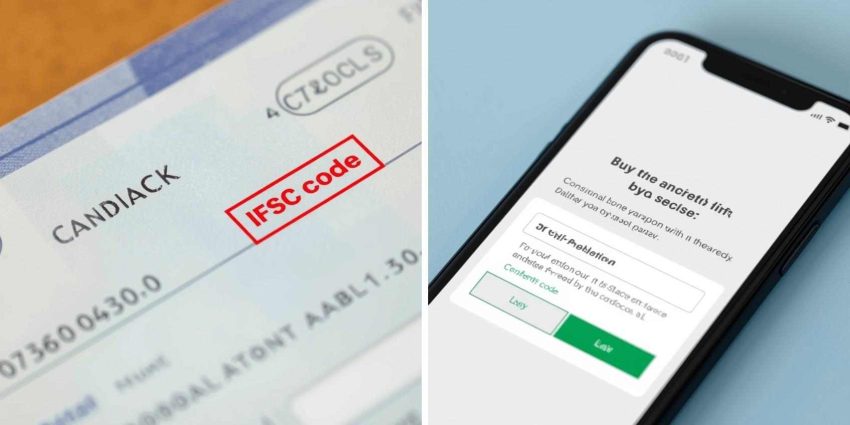

RBI’s New 2FA Mandate: What It Means for Your Digital Payments Authentication Starting 2026 In a landmark move to fortify the digital payments landscape, the Reserve Bank of India (RBI) has announced a comprehensive framework for strengthening authentication mechanisms. As of September 25, 2025, new guidelines have been issued that will fundamentally alter how we…

IFSC Code updates 2025: What Every Indian Bank Customer Must Know to Avoid Payment Failures

IFSC Code Updates 2025: What Every Indian Bank Customer Must Know to Avoid Payment Failures The era of digital banking has redefined convenience for India’s millions of customers. Yet, few realize that behind every successful online fund transfer—using NEFT, RTGS, or IMPS—lies a tiny but crucial detail: the Indian Financial System Code, or IFSC. In…

Credit on UPI: How New RBI & NPCI Rules for Pre-Sanctioned Loans Are Changing Digital Payments

Credit on UPI: How New RBI & NPCI Rules for Pre-Sanctioned Loans Are Changing Digital Payments The Unified Payments Interface (UPI) has fundamentally transformed how Indians transact, moving from a novelty to an everyday necessity. Now, it’s poised for its next major evolution: the integration of credit on UPI. Following up on the Reserve Bank…

Banking System Liquidity Deficit Explained: RBI Intervenes in Cash Crunch

India’s Banks Face Cash Crunch: Is Your Money Safe as RBI Steps In? In a significant development for India’s financial sector, the banking system’s liquidity has tipped into a deficit for the first time in the current fiscal year. On September 22, 2025, data from the Reserve Bank of India (RBI) revealed a deficit of…

The Rise of Private Credit in India: The New Force Shaping Indian Business

Private Credit in India: Growth, Risks & Opportunities in 2025 Beyond the familiar realms of stock markets and traditional bank loans, a new and powerful financial force is rapidly coming of age in India: private credit. Once a niche asset class, it has exploded into a thriving, multi-billion-dollar industry, attracting a wave of global and domestic…

Understanding the RBI New Regulatory Framework for 2025

A New Era of Regulation: RBI Unveils a Framework for Agility and Transparency In a landmark move set to redefine India’s financial landscape, the Reserve Bank of India (RBI) has announced the establishment of a new institutional architecture designed to streamline and modernize its regulatory processes. Effective from October 1, 2025, the central bank is…

RBI Payment Aggregator Rules Shake Up Fintech: What It Means for Your Daily Transactions

RBI Payment Aggregator Rules Explained | Impact on UPI & Rent Payments In a significant move to streamline the digital payment ecosystem, the Reserve Bank of India (RBI) issued its consolidated Master Directions for Payment Aggregators (PAs) on September 15, 2025. These new regulations overhaul the existing framework, bringing new entities under the RBI’s purview…

South Indian Bank Launches UPI GST Payment | Easy GST Payments

Game-Changer for Taxpayers: South Indian Bank Launches UPI GST Payment Facility! In a landmark move towards frictionless digital governance, South Indian Bank (SIB) has pioneered a facility that empowers Indian taxpayers to pay Goods and Services Tax (GST) using the Unified Payments Interface (UPI). Announced in mid-September 2025, this new approach allows millions of businesses…

UPI Transaction Limit Increase: Pay up to ₹5 Lakh for Insurance, Investments

UPI Transaction Limit increase : Now it’s ₹5 Lakh! Your Guide to the New Transaction Rules from September 2025 India’s Unified Payments Interface (UPI) has been nothing short of a global phenomenon. From street vendors to high-end showrooms, the ubiquitous QR code has fundamentally altered the nation’s relationship with money, championing a digital-first economy. However,…