Introduction: Why GST Reforms India Matters Right Now India’s Goods and Services Tax (GST) has entered an exciting new chapter in 2025 with the government’s launch of GST 2.0—a sweeping reform aimed at boosting ease of business, lowering the tax burden on daily essentials, and giving a much-needed push to consumption-led growth. As the revised…

Blogs

UPI Transaction Limit Increased to ₹10 Lakh: What It Means for You

Introduction: UPI’s Unstoppable Growth The Unified Payments Interface (UPI) continues to drive India’s digital transformation, rewriting how money moves across the country and even beyond its borders. What started in 2016 as a simple peer-to-peer transfer mechanism now shapes everything from insurance premium payments to credit card bill settlements, business-to-business payments, and international travel expenses….

“Is Indian Financial System Designed to Keep You Poor?” – Viral Finance Debate Explained

Introduction On September 11, 2025, a provocative post by finance influencer Akshat Shrivastava sparked a nationwide debate: “Is India’s financial system designed to keep the average citizen poor?” Social media lit up, news channels weighed in, and thousands of professionals, entrepreneurs, and salary-earners began fiercely discussing how taxes, transaction costs, commissions, and regulatory hurdles impact…

SEBI Regulations 2025 Changes: What They Mean for IPO Investors, Mutual Funds & Foreign Investors

Introduction India’s securities markets are undergoing a profound transformation, powered by a wave of new regulatory reforms from the Securities and Exchange Board of India (SEBI) in September 2025. The latest board meeting on September 12, 2025, delivered a set of policy changes that impact IPO processes, mutual funds, foreign portfolio investor (FPI) access, and…

How Bancassurance Partnerships are Transforming Insurance in India: RBL Bank & LIC Latest Example

Introduction The Indian insurance sector is witnessing a historic evolution, driven by new business models and digital innovation. Leading this transformation in September 2025 is the high-profile partnership between RBL Bank and the Life Insurance Corporation of India (LIC), signaling a significant leap in the growth and outreach of bancassurance. With over 3,600 LIC branches…

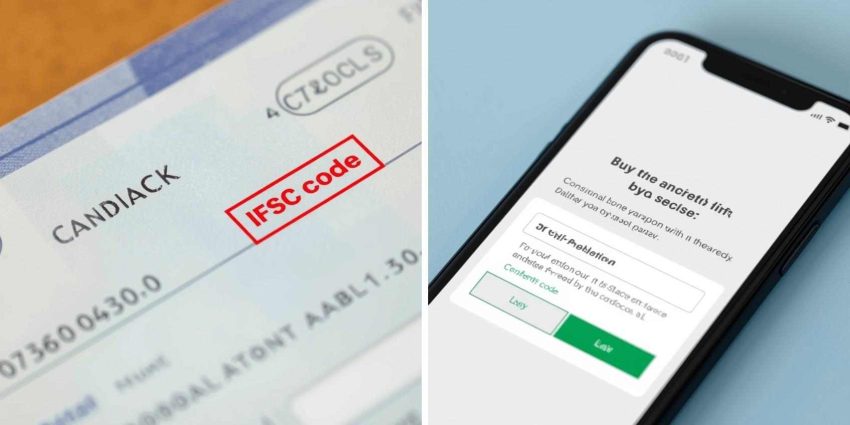

The World of IFSC Code updates: Why Every Digital Transaction in India Depends On It

IFSC Codes: Foundation of India’s Digital Economy The Indian Financial System Code (IFSC) has become the central pillar of secure and seamless digital banking in India. Every time a person initiates an NEFT, RTGS, or IMPS transaction, the IFSC code plays a critical role—ensuring funds are sent to the correct branch and recipient within seconds….

GST 2.0 is Here: How the New GST Rates Slabs Will Affect Your Monthly Budget

Understanding the New GST Rates (Sept 2025): What’s Cheaper, What’s Dearer? In a significant overhaul of the nation’s indirect tax system, the much-anticipated “GST 2.0” reforms have come into effect starting September 22, 2025. This new chapter in India’s Goods and Services Tax (GST) journey aims to simplify the tax structure, reduce the burden on…

RBI’s New Digital Payment Authentication Rules: A Deep Dive for Secure Transactions

RBI’s New 2FA Mandate: What It Means for Your Digital Payments Authentication Starting 2026 In a landmark move to fortify the digital payments landscape, the Reserve Bank of India (RBI) has announced a comprehensive framework for strengthening authentication mechanisms. As of September 25, 2025, new guidelines have been issued that will fundamentally alter how we…

IFSC Code updates 2025: What Every Indian Bank Customer Must Know to Avoid Payment Failures

IFSC Code Updates 2025: What Every Indian Bank Customer Must Know to Avoid Payment Failures The era of digital banking has redefined convenience for India’s millions of customers. Yet, few realize that behind every successful online fund transfer—using NEFT, RTGS, or IMPS—lies a tiny but crucial detail: the Indian Financial System Code, or IFSC. In…

What is the MF-VRA Scheme? AMFI’s New 401(k)-Style Plan Explained

AMFI’s 401(k) Plan for India: Could the New MF-VRA Scheme Secure Your Retirement? For decades, retirement planning in India has been a fragmented landscape dominated by traditional instruments like the Employee Provident Fund (EPF), Public Provident Fund (PPF), and fixed deposits. While effective, these options often fall short in a country where a majority of…